Emerging-Market Stocks Drop, Halting Longest Rally Since 2005; Yuan Falls

Wednesday, June 23rd, 2010China may allow the yuan to strengthen to deflect criticism from its trading partners and curb inflation, while protecting a recovery in its exports. Photographer: Nelson Ching/Bloomberg

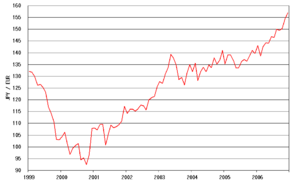

Emerging-market stocks fell for the first time in 11 days on renewed concerns Europe’s debt crisis will hurt the global economy.

The MSCI Emerging Markets Index lost 0.8 percent to 970.42 as of 3:10 p.m. in Singapore, snapping a 10-day, 10 percent rally that had lifted the gauge to a seven-week high. The yuan fell the most since December 2008 after yesterday strengthening the most in five years.

Developing-nation stocks snapped their longest rally since September 2005 after European Central Bank governing council member Christian Noyer said some banks are facing funding problems and Standard & Poor’s Ratings Services said Spanish lenders face difficult years as credit losses mount. Economists surveyed by Bloomberg predict Germany’s Ifo institute will say today its business climate index fell in June.

“I don’t think the euro crisis is even close to over given that there are fundamental solvency issues,” James McCaughan, chief executive officer of Principal Financial Investors, said in a Bloomberg Television interview from Kuala Lumpur.

Poly (Hong Kong) Investments Ltd. paced a drop among Chinese developers after the National Development and Reform Commission said property prices in larger cities are poised to steadily decline. The Kospi index fell 0.5 percent, the most in two weeks, after MSCI Inc. kept South Korea as an emerging market in an annual review. OAO Lukoil paced a 1.2 percent drop in Russia’s Micex index after crude oil prices declined.

Poly (Hong Kong) Investments, a developer of residential and commercial properties, fell 2.1 percent in Hong Kong trading. China Overseas Land & Investment Ltd., a developer controlled by the Chinese construction ministry, dropped 1.9 percent.

Yuan Weakens

The stocks surged yesterday after the People’s Bank of China said June 19 it would increase the yuan’s flexibility, spurring speculation a stronger yuan will tame inflation and reduce the need for interest-rate increases.

The yuan declined 0.17 percent to 6.8095 per dollar after climbing 0.4 percent yesterday.

The end of the yuan’s peg may not be “enough for a turnaround” in property stocks as the benefits from a stronger currency will be countered by the outlook of government policy and supply, Morgan Stanley analysts led by Derek Kwong said in a report today.

Fitch Ratings cut its long-term credit rating on BNP Paribas, France’s largest bank, citing a “deterioration” of the company’s asset quality. The report came as Standard & Poor’s lowered its economic growth forecast for Spain to an average of 0.7 percent a year through 2016 from 1 percent, saying Spanish banks face mounting credit losses and “substantial strain” on revenue generation.

Samsung Electronics

Samsung Electronics Co., an electronics maker that gets more than a fifth of its sales from Europe, retreated 1.7 percent in Seoul.

The stock also fell after MSCI said it will skip upgrading South Korea to developed-market status for a second year, citing the “rigidity” of its investor identification system and the lack of an active offshore market for the country’s currency, as well as anti-competitive practices relating to stock market data.

“There may be disappointment in the short term,” said Chu Moon Sung, a Seoul-based fund manager at Shinhan BNP Paribas Asset Management Co., which manages $26 billion.

Lukoil, Russia’s second-largest oil producer, lost 0.6 percent while OAO Tatneft declined 1.2 percent. Crude oil prices fell as much as 1.1 percent to $76.97 as optimism faded that China’s yuan policies would strengthen the global economic recovery and after Goldman Sachs Group Inc. reduced its crude price forecasts today.

To contact the reporter on this story: Shiyin Chen in Singapore at [email protected]

Related articles by Zemanta

Related Blogs

- DIV Tags: The Building Blocks Of CSS Page Layout « Web Dev & Computer Articles

- DIV Tags: The Building Blocks Of CSS Page Layout « Web Dev … | CSS Guru How to CSS

- York Daily Record Div. II boys’ tennis all-stars

- Yahoo! Search Marketing Blog » Search Alliance Update #2

- Expert Web Designer - CSS/xHTML/DIV by tvibes

- Free Outdoor Yoga Class @ the Comcast Center This Saturday | Things to Do in Philadelphia: uwishunu Philly

- Quote Of The Day: Sooner Or Later Edition | The Truth About Cars

- SLAM ONLINE | » Video: Ron Artest at Lakers’ Title Parade

- Google Gains 1% of Search Market Share in May | Search Engine Journal

- SayUncle » Quote of the Day

- So Much for the Market’s Yuan Rally Today | The Big Picture

- Sternberg Will Sell Team If Tampa And St. Pete Can’t Get Along | Rays Index

- Forum class (forum, board) - PHP Classes

- MetalSucks » Blog Archive » HEIRS TO THIEVERY: MISERY INDEX’S ANGER DIRECTED AT MORE THAN THE GOVERNMENT GETTING THEIR HANDS IN MEDICARE

- Indo Article Directory » How to write title on eBay

- Chances Ford is 25 percent hybrid by 2020? - Hybrid Cars and Plug-in Vehicles - Hybridcarblog

- Learning to use CSS and DIV Tags for Columns in Dreamweaver | HTML5 Samples, Tutorials and News

- Auto Insurance Quote Online

- Lady Gaga To Reveal New Album Title Via Tattoo | GantDaily.com

- ASA Staffing Index At 82-Week High | Daily Markets

Related Websites

Related Websites -

Forex International Currency Market Naturally, with the demanded account difficult financial situations, namely shortage of means, the big quantity of people are almost every day set by a problem to earn in the Internet the real incomes. In addition to it is necessary to allocate that to earn additionally in a network there are......

Forex International Currency Market Naturally, with the demanded account difficult financial situations, namely shortage of means, the big quantity of people are almost every day set by a problem to earn in the Internet the real incomes. In addition to it is necessary to allocate that to earn additionally in a network there are...... -

Dow slides below 10,000 [/caption] NEW YORK – Stocks fluctuated Friday as traders juggled worries about how Europe is handling its debt crisis. The Dow Jones industrial average zigzagged in a tight range after making bigger swings that briefly sent it below 10,000 in the opening minutes of trading. The volatility comes a day......

Dow slides below 10,000 [/caption] NEW YORK – Stocks fluctuated Friday as traders juggled worries about how Europe is handling its debt crisis. The Dow Jones industrial average zigzagged in a tight range after making bigger swings that briefly sent it below 10,000 in the opening minutes of trading. The volatility comes a day...... -

Being Hybrid is not Necessarily Being Good In today's day and age, hybrid has become a synonym for what is good in the eco-friendly movement. Not all hybrids are created the same, and in actuality many rate quite poorly. Whether it is poor fuel economy or a negative impact on the environment, these hybrids show that bearing......

Being Hybrid is not Necessarily Being Good In today's day and age, hybrid has become a synonym for what is good in the eco-friendly movement. Not all hybrids are created the same, and in actuality many rate quite poorly. Whether it is poor fuel economy or a negative impact on the environment, these hybrids show that bearing...... -

Apologetic Toyota looking to outside for quality input [/caption] Toyota Motor Corp's president apologized on Friday for safety problems and said the automaker would bring in outside experts to review quality controls, a highly unusual action for a company that has epitomized world-beating industrial standards. "I would like to take this opportunity to apologize from the bottom of......

Apologetic Toyota looking to outside for quality input [/caption] Toyota Motor Corp's president apologized on Friday for safety problems and said the automaker would bring in outside experts to review quality controls, a highly unusual action for a company that has epitomized world-beating industrial standards. "I would like to take this opportunity to apologize from the bottom of...... -

Dubai debt default triggers Global Market selloff The Dow Jones Industrial Average dropped on Friday by 154.48 points or 1.48% down on Wednesday's close (10,464.40) to 10,309.92 points, breaking a 3 week rally and finishing 0.1% down for the week. Wall Street closed Thursday for Thanksgiving, then reopened for a half day session in the midst of......

Dubai debt default triggers Global Market selloff The Dow Jones Industrial Average dropped on Friday by 154.48 points or 1.48% down on Wednesday's close (10,464.40) to 10,309.92 points, breaking a 3 week rally and finishing 0.1% down for the week. Wall Street closed Thursday for Thanksgiving, then reopened for a half day session in the midst of......