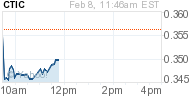

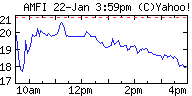

On Thursday September 25th 2008, Washington Mutual Inc aka WaMu Inc. or WMI or WaMu, common shares trading under the symbol WM, opened at $2.62, rose to $2.69 within the first hour, and then fell on average for the rest of the day and closed at $1.69. In after hours trading it quickly dived without stopping to as low as $0.09 and then closed a couple hours later at $0.16. Take note it fell 90.5% just in after hours. During the regular day it fell 35.5%. For the entire day it fell 93.89%. All these percentages are based on the open, and excluding the pre-market trading data, which I do not have. For the day, the DJIA rose 196.89 points, and closed at 11,022.06

Clearly anyone who held WaMu through the day experienced a financial wipeout in their position. What caused this wipeout? In a statement issued on the night of September 25th the Office of Thrift Supervision (OTS), an office of the US Treasury, said “An outflow of deposits began on September 15, 2020, totaling $16.7 billion. With insufficient liquidity to meet its obligations, WaMu was in an unsafe and unsound condition to transact business. The OTS closed the institution and appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. The FDIC held the bidding process that resulted in the acquisition by JPMorgan Chase.” (link). WaMu had been sold and seized. The process of selling and seizing WaMu had actually begun prior to September 15th, reportedly having been started during the first week of September, 2008.

Washington Mutual Inc is a bank holding company that owned two banks, the Washington Mutual Bank, Henderson, NV and a subsidiary of that bank, Washington Mutual Bank, FSB, Park City, UT. The first mentioned bank was the main banking operation, and the focus of everyone’s attention. Both banks received the same treatment simultaneously on September 25th, 2008. For brevity they are usually referred to singularly as the Washington Mutual Bank aka WaMu Bank or WMB or WaMu. For the rest of this text this convention will be followed and they will be referred to as one enterprise and principally referring to the vastly larger Henderson NV incorporated bank.

Seventeen days earlier on Monday September 8th, the Board of Washington Mutual removed CEO Kerry Killinger due to losses from subprime mortgages and credit card loans and replaced him with Alan Fishman. WaMu simultaneously announced (link) that they had negotiated a Memorandum of Understanding with the OTS concerning aspects of the bank’s operations. It concluded with this sentence. “The business plan will not require the company to raise capital, increase liquidity or make changes to the products and services it provides to customers.” WaMu’s new CEO Alan Fishman was experienced in bank mergers. In 2004 as CEO of Independence Community Bank Corp he completed a merger with Staten Island Bancorp, Inc and then in 2006 he worked out the well executed sale of Independence Community Bank Corp to Sovereign Bancorp. His employment and hefty salary with WaMu were seen as an indication WaMu was setting itself up for a merger.

For the ten days prior to the seizure WaMu experienced an acceleration of withdrawals, and corresponding draw downs in its liquidity, that the regulators at the OTS and FDIC say justified a seizure of the bank. The accounts that withdrew were mostly large retail accounts of over $100,000, which at the time was the FDIC insurance maximum. These accounts were used primarily for payroll purposes. These accounts were mostly in California, where the memory of the IndyMac bank seizure was likely on their minds. The speed and amounts withdrawn do not qualify as a bank run, as a bank run is a complete wipeout of deposits over a few days. At most it could be characterized as a walk on the bank. The withdrawals were done by electronic banking over the internet and by wired funds. It was not in the news, people were not lined up outside the bank. WaMu was the largest thrift or savings & Loan in the nation, and the sixth largest bank by deposits. They had 2,239 branches in 15 states, concentrated in the west and south. They were large enough that the Federal Reserve assigned them onsite full time bank inspectors to monitor, among other things, liquidity levels. The Federal Reserve was witness from beginning to end of the liquidity draw down.

A walk on a bank, is a mild form of a run on a bank. Bank runs were typical of the great depression which started in 1929. Customers wanted their cash in their hand, because if a bank died and locked its doors, their cash would be forever beyond their reach. Bank runs have an effect on the public and the government that tends to snowball and be a self fulfilling prophecy. If a new bank has a problem, because a bank run has happened recently, it may be happening again now, so they do a run on that bank etc. Bank runs close banks down, and draw their cash down to zero. A slew of bank runs that closes banks down is known as a bank panic.

In response to the bank panics of 1929 and the early 1930’s, in 1933 the government created the Federal Deposit Insurance Corporation (FDIC). The FDIC is a government corporation that provides insurance on bank deposits. The primary reason for creating the FDIC was to prevent bank runs, from the demand side, depositors demanding cash all at once at the bank, which had been the typical bank run scenario in the depression of the early 1930’s. The mechanism to do this was deposit insurance so that even if a bank locks its doors, your deposits are covered up to the insurance maximum and you will be paid your money from the insurance fund. At the time of the WaMu seizure the insurance covered up to $100,000. In large part due to the WaMu catastrophe the FDIC has implemented a temporary increase in the amount of deposit insurance, and it is now $250,000 until Dec 31, 2020, unless extended. The Chairman and four Board of Directors of the FDIC are all appointed by the President and confirmed by the Senate, with no more than three being from the same political party. The FDIC is self funded through its insurance premiums, which are paid by the banks. The FDIC has an immediate $30 billion line of credit with the US Treasury, and procedures are in place if more credit is needed. From 1996 - 2006 the FDIC waived the collection of the bank insurance premiums as it was at the upper limit of its legal reserves.

The Federal Reserve system was created in 1913. One primary reason for creating the Federal Reserve was to prevent bank runs, from the supply side, the running out of cash at the bank, which had been a problem causing bank runs in the recession of 1907. The mechanism for doing this is by the banks loaning liquidity to each other in a process called Federal Funds, which is short for Federal Reserve Funds. Then there is a process of a bank borrowing straight from the Federal Reserve called the Discount Window. The Federal Reserve is a private corporation whose stockholders are the biggest banks in the country. The Chairman and the six Board of Governors of the Federal Reserve are all appointed by the President and confirmed by the Senate. This is the legal extent of the Governments involvement with the Federal Reserve. Thus the government has weak control over the actions of the Federal Reserve. All banks in America are members of the Federal Reserve System. All paper money is printed by the Treasury per the amounts ordered by the Federal Reserve. All electronic money, wires, credit cards, debit cards etc and all check book money, is under the monetary policies of the Federal Reserve. The Federal Reserve controls how much money, (cash, electronic, check book) banks have on hand through its regulations and membership requirements. It maintains this flexibility so that it may meet the liquidity demands of banks.

WaMu was the largest thrift in America and part of the Federal Reserve System. WaMu had some no pay and slow pay mortgage loans, like most banks in America today. These loans were not an overwhelming problem for WaMu, as they had enough cash reserves on hand to last two years at the current bad loan rate.

On March 10, 2020 the Dot Com bubble burst. The Federal Reserve began lowering interest rates to make borrowing more attractive, to stimulate the economy out of the slump caused by the Dot Com bubble bust. On September 11, 2020 there was the WTC-Pentagon 9-11 tragedy, and the Federal Reserve continued lowering interest rates to keep the economy moving. On July 30, 2020 the Federal Funds rate was 7.03% and by July 30, 2020 it was 1.03%, a drop of six points or 85.7%. The swing from March 2000 was probably wider, but the data older than July 2000 could not be found. People saw this as a good time to take out a mortgage as interest rates were low. For the banks the home loans became an even more important source of borrowers/customers. Competition was high and banks lowered requirements to receive loans, to make business and to get as big a share of the business as they could. As time went by to maintain the business, mortgages were being more loosely structured and borrowers more liberally accepted. The least stringent home loans were known as subprime loans, as they were made to less than prime customers. Loan structures such as ARMS and HELOC were used. Often the mortgages were structured with low payments up front, and higher payments in the later years. Often these mortgages were sold to other lenders after they were written, and WaMu had purchased a lot of their mortgages. As time passed some subprime borrowers were unable to make their payments on time, others could not make their full payments, and some lost the ability to make any payments at all.

Banks are regulated and they have to lend the appropriate amounts of money to the appropriate people, or else they put depositors, borrowers, and investors all at risk. The OTS and FDIC are two of the government agencies that regulate banks. The OCC being the third. Regulation was lax throughout the banking system during the 1990’s and early 2000’s and many banks did things which regulators should have caught and should not have allowed. One OTS regulator, Darrel Dochow, who was demoted in 1989 for misregulating the infamous and seized Lincoln Savings and Loan, had risen again within the OTS and was now in charge of Washington Mutual, Countrywide, IndyMac and Downey Savings and Loan, among other banks that have been seized or merged in the current credit crisis. This type of lack of regulating stamina which tends to need to be followed up by a bank seizure is a definite part of the current financial crisis. If regulators did their jobs and enforced banking regulations, seizures like WaMu, and much of the current financial crisis could have been avoided. This problem extends to the SEC which regulates stock trading and has been lax on their watch this whole time as well. The SEC has been like this probably because they have no way to enforce their laws and regulations and do not want to show that. Just as the FDIC has no way to provide deposit insurance, and seized WaMu so they did not have to show that either. The entire credit crisis is due to the governments inability to regulate, enforce regulation, and even trace what is happening in America finances. The foxes are running the hen house, and the government is left to just hand them whatever banks and money they want to keep the financial system moving.

A bank’s assets are its loans, because loans are where people owe you money plus interest, an income stream. Deposits are a liability, because the bank owes the depositor the money, plus interest, and is liable for its payment on demand.

Insolvency is when a person or company can not meet the current obligations or payments on their debts, using whatever capital means they have available to them, including selling assets. WaMu borrowed money from citizens like all banks in many forms, Cds, secured bonds, unsecured bonds etc. to get money to do its business. WaMu was perfectly able to make the interest payments and redemption payments on its debts. WaMu was not an insolvent or bankrupt bank. WaMu held a lot of small deposit accounts, and depositors make withdrawals, thus liquidity, having funds available on hand for withdrawals was WaMu’s primary concern.

Bankruptcy is a courts legal recognition of a company’s insolvency. There are three types of bankruptcy, Chapter 7 liquidation, Chapter 11 reorganization, and Chapter 13 personal bankruptcy.

Liquidity is when the cash on hand and current income stream is able to meet or beat the current debt service and other liability requirements, without having to sell assets. When the OTS said WaMu had “insufficient liquidity to meet its obligations”, this was only a forecast, and not a fact. They were stating an opinion based on if the walk on the bank continued at the same rate for some time, and without intervention. This would be a highly unlikely occurrence. Actually no bank has that kind of liquidity as the fractional reserve system rejects that principle. It has now become know that there was a system wide rush of withdrawals the week after the Lehman bankruptcy, that totaled $550 billion in money market accounts alone, and this begs the question, during that week how bad were WaMu’s liquidity ratios compared to the other bank’s liquidity ratios for that same week. Was WaMu the only bank on course for “insufficient liquidity to meet its obligations” that week, and since this is doubtful, why was WaMu the only bank groomed well ahead of time for a seizure.

As subprime loans fail to pay, a bank is losing its income stream, or it is losing its liquidity, as the monthly checks are not showing up. Less money coming in means less is available to pay the monthly interest to bond holders, Cds, savings deposits and also for customer withdrawals and redemptions etc. WaMu’s liquidity was slowly shrinking due to its subprime loan failures, but it was not at a problem level, and WaMu was seeking solutions. In March 2008, JPMorgan Chase offered to buy WaMu for $8.00 a share, hoping the bank would accept it as a way out of its creeping liquidity problem. For JP Morgan it would have meant a huge increase in their branch network and deposit base. WaMu declined and instead on April 8th took a seven billion dollar cash infusion, two billion from an investment firm TPG Capital, in trade for 822,857 new common shares at $8.75, with the remainder preferred shares convertible to common shares, and five billion from other investors in trade for new common shares. Total new common shares issued at the onset of this deal being 176 million, and more created when the preferred shares converted. See Note 9 on the bottom of page 21 here. David Bonderman the CEO of TPG had been on the WaMu Board of Directors from 1997-2002. With this new deal he once again became a member of the Board of Directors. Another part of the deal was that WaMu had to accept an anti-dilution clause wherein if WaMu sold itself, or issued new shares worth over $500 million, for less than $8.75 a share, within the next eighteen months, TPG would be paid the difference against their shares. Shareholders disliked this whole deal, but they approved it to avoid stiff built in penalties. Although this cash infusion helped, there was a liquidity problem for WaMu in July 2008 when IndyMac failed. After IndyMac most depositors returned their money, but from then until the September 15th 2008 Lehman bankruptcy there was a slow drain on the total level of deposits. When Lehman went bankrupt on September 15th the rate of deposits leaving WaMu accelerated. WaMu was aware of the problem, and in early September 2008 before the Lehman bankruptcy, WaMu made the decision to seek a buyout merger. On September 8th they hired a new CEO Alan Fishman. On September 17th they announced they had chosen Goldman Sachs as a broker to find a buyer and work out a deal. On this same date TPG waived its anti-dilution clause to help facilitate the sale of WaMu. There were five to seven major banks interested, including Banco Santander, Citigroup, HSBC Holdings, Toronto-Dominion Bank, Wells Fargo and JPMorgan Chase.

The entire Savings and Loan system is in a similar situation. To receive a Savings and Loan charter you have to limit commercial lending to 20% of assets, of which half must be for small businesses. To receive advances from the Federal Home Loan Bank, mortgages and consumer related lending must be 65% of assets. Everything is structured to put S&Ls into doing predominantly home mortgages.

Congress under pressure from both the Federal Reserve and the Treasury was being urged to authorize government funds to bailout the banks with the subprime loan failures and thus the increasing liquidity problems. The idea at the time was the government would create new government obligations, bonds of various term lengths, and swap these for the banks’ subprime loans. As the government has the ability to control tax revenue by increasing taxes, its ability to pay its debt obligations is the highest you could have, because it can and does enforce the payment of taxes. If it needs money to pay a debt it increases taxes. The government would put itself in charge of collecting the subprime debts as well, and defaults are more easily absorbed by them as they are also offset by its tax collecting abilities.

The bailout loan swap plan would insure the banks current income streams would increase as all payments would be made, and also be quite certain going forward as the government is not likely to go out of business. This plan is essentially the $700 billion bailout plan that was being discussed in Congress at the time. This plan would have strengthened WaMu considerably, and even to the point where some were speculating WaMu would not have to sell and could continue on as an independent bank. It also made WaMu and all the banks a much better investment or merger candidate as much more of the loan portfolio value and income streams would be certain, and known. In the first week Goldman Sachs had been unable to find WaMu a buyer. The one huge obvious problem was the bailout talks and what their results would be, and the end effect that would have on the income value of WaMu’s loan portfolio. There was another problem too though. Unknown to anyone the FDIC had already been offering WaMu secretly to the same potential customers that Goldman Sachs went to, but as a branches, deposits and loan portfolio only sale, free of all financial obligations to bond holders and of all claims of shareholders, to be done by private auction, and implemented by a WaMu bank seizure. This had killed WaMu’s chance to find a buyer from another bank, and WaMu was now talking to two private equity firms, the Blackstone Group and the Carlyle Group, to see if they would be interested in buying the bank.

WaMu’s average account was only $5,200.00, well within the FDIC insurance range. In aggregate these FDIC insured accounts were much more in value then the FDIC had in cash to pay insured depositors. Since if it ever came down to it, the FDIC would be unable to make good on its insurance plan, without borrowing from the Treasury, the FDIC had offered outwardly to help Goldman Sachs in brokering a deal for a buyout of WaMu. As soon as the rates being received for the subprime loans in the bailout was known the banks could then establish a value and price for the bailed out WaMu. This makes sense, and this is what investors were told and thought, but the main potential customers already knew WaMu was to be seized and auctioned, and for that to work it had to occur before the bailout. It was not WaMu that had the liquidity problem, it was the FDIC that had the liquidity problem, and the FDIC chose to protect what little liquidity they had by preemptively and unjustly seizing WaMu. The FDIC decided to avoid any chance of being caught short of cash, and used their regulatory powers to transfer their cash problem onto the WaMu shareholders and debt holders by wiping out their investment positions.

There is a bit of a jumble in the FDIC’s legislation here. One is any potential bank failure on the horizon that could threaten the FDIC’s funds and thus ability to insure deposits should be seized before that event in an early resolution seizure. The second is that any bank seizure that could cause systemic risk, should not be seized, and the bank should be handled another way. These two regulations describe the same banks. There is not a precise definition for either regulation. If the bank’s failure could take down the FDIC it qualifies as a systemic risk ipso facto. Similarly there is a regulation that the FDIC must transact seizures at least cost to the FDIC, and another regulation that they must conduct operations in a manner which maximizes the net present value return from the sale or disposition of seized assets. How do both parties win at this game? The FDIC chose early resolution seizure over systemic risk for WaMu and now we are all suffering from the systemic risk, which will go on for years.

The White House and Congressional Finance Committee members began discussing the bailout together on Wednesday September 17th, the same day that WaMu announced that it was for sale. The actual Congressional hearings were started the next day, and were held everyday thereafter. The bailout, now known as The Emergency Economic Stabilization Action (EESA) of 2008, was passed Saturday October 2nd and made law on Sunday October 3, 2020. The first implementation of bailout funds was the purchase of preferred shares in twenty-five US banks, rather than a debt swap. This was a bailout technique that England had recently used for handling the credit crisis.

Just previous to the initiation of the bailout proceedings, due to falling stock prices in financial issues, and many of the banks, for the entire year, thirty day bans on short selling were introduced. The first one announced Tuesday July 15th was on nineteen finance stocks, and solely a ban on naked short selling. Kerry Killinger then CEO of WaMu had asked Treasury Secretary Henry Paulson to put WaMu on that list, but he was denied. There was no valid reason for WaMu’s omission or denial. On Wednesday September 17th naked short selling was banned on all stocks, and on Friday September 19th all short selling of any kind was banned on 799 finance stocks, and this was good until Thursday October 2nd, and was later expanded and extended. WaMu was on the list of 799 finance stocks. All short positions on the 799 stocks had to be closed out within three days, and thus be covered by the market close of Wednesday, September 24th. Manipulation is the reason the SEC issued the short bans. Hedge Funds and other shorts can drive a stock price down and profit from the free fall, or on options trades, or on buying to go long at a reduced price, and it is possible with enough coordination to drive a company out of business and take it over. Currently shorting is very profitable as the uptick rule was removed and naked shorting has been allowed. It is interesting to note that there was little short covering in WaMu, thereby disobeying a SEC order, and that the bank was coincidently seized the day after all shorts should have been, but were not, covered. It has now known that the shorts covered in the days of the post seizure trading and only had to pay pennies a share to cover, and made huge profits. When the uptick rule is in place and naked shorting disallowed most people have no problems with short selling. Shorting provides a counter balance to longs and when regulated well can be a stabilizing influence on a stock’s price. Shorts sell stocks at high prices and buy them at low prices and profit the difference. When stocks drop, shorts buy, creating demand at low levels and slowing and reversing descents, conversely when stocks soar, shorts sell, and reduce run away inflation of a stock’s price.

On Thursday September 11th WaMu provided an Update on Expectations for Third Quarter Performance (link), with the official results scheduled for Wednesday October 22nd. This is part of their release, “The company expects its capital ratios at quarter-end to remain significantly above the levels for well-capitalized institutions and continues to be confident that it has sufficient liquidity and capital to support its operations while it returns to profitability. Net interest income is expected to be in line with the second quarter. The third quarter provision for loan losses is expected to be approximately $4.5 billion, down from $5.9 billion in the second quarter while reserves are expected to build, as described in greater detail below. Net charge-offs are expected to increase by less than 20 percent in the third quarter compared with a growth rate of nearly 60 percent during the second quarter. Non interest income is expected to be approximately $1.0 billion, up significantly from the second quarter, reflecting continued growth in depositor and retail banking fees (up 6% from the second quarter) as well as stronger MSR results due to slower prepayment speeds. Non interest expense is expected to be down approximately $200 million, reflecting expectations for lower resizing costs and lower foreclosed asset expense.” It also had this to say about its Liquidity and Capital: Retail deposit balances at the end of August of $143 billion were essentially unchanged from year-end 2007. In addition, the company continues to maintain a strong liquidity position with approximately $50 billion of liquidity from reliable funding sources. The company’s tier 1 leverage and total risk-based capital ratios at June 30, 2020 were 7.76%, and 13.93%, respectively, which were significantly above the regulatory requirements for well capitalized institutions. The company expects both ratios to remain significantly above the levels for well-capitalized institutions at the end of the third quarter.

Things were better than the previous quarter. Both capital and liquidity were well within acceptable limits. The worst thing was that the level of deposits was were it had been at the end of 2007. The lack of growth in deposits was a primary reasons WaMu was seeking a merger. The deposits being at this level was not an immediate problem. Considering there were possible benefits from the bailout, and once the bailout details were known one way or another, an orderly buyout merger would be possible, things were looking pretty good.

On Monday September 15th Standard & Poors issued a downgrade of some of WaMu’s bonds, but made this positive statement about their liquidity. ” WAMU’s overall liquidity profile at the bank and the holding company is positioned to withstand this weak credit cycle through the end of 2010. During the past year, WAMU has conservatively and prudently managed its holding company liquidity position. It faces minimal debt maturities through the end of 2009. WAMU reaffirmed that its outstanding debt is not subject to rating triggers or other terms that would cause acceleration.”

Also on September 15th, Lehman Brothers, the fourth largest investment bank in the US, declared Chapter 11, bankruptcy reorganization. Lehman Bros was an investment bank, not a depository bank. It was the largest bankruptcy in US history. It was the first major Wall St firm to declare bankruptcy in recent memory. In March 2008 Bear Stearns another large investment bank, had come close to bankruptcy, but the government worked out a deal for them where JPMorgan Chase ended up purchasing Bear Stearns. The Lehman Bros bankruptcy put everyone on edge.

On September 18th Alan Fishman the new CEO released a letter (pdf link) to shareholders in which he stated “Capital ratios describe the financial strength of a bank. Our ratios continue to be well in excess of the levels that government regulators require of “well capitalized” institutions. We also have an ample supply of funds on hand to meet your needs and the needs of our other customers and our day-to-day operations.” That the WaMu bank was well capitalized has never been disputed and the OTS in a Fact Sheet (pdf link) they issued on WaMu on September 25th 2008 said “WMB met the well capitalized standards through the date of receivership.”

Thus going into the week of Thursday September 25th for WaMu and WaMu longs there were three reasons for positive expectations, first large short positions covering, second a possibly beneficial outcome to the bailout meetings, and third shortly after the congressional hearings a buyout merger. The total amount of outstanding shares short was 26% of the float, or about 420,000,000 shares. Who were these shorts? Did JPMorgan Chase have a large short position, did Citigroup?

The three credit ratings services all gave WaMu debt downgrades during the week, first by Moody’s on Monday September 22nd, then Fitches on Wednesday September 24th and finally Standard & Poors on Wednesday evening September 24th. Essentially they were all downgrades from junk to junkier. Some people saw this as window dressing being done before the bailout was passed, and that it was being done so that whatever plans the bailout came up with, the debt would be freshly rated for carrying out that decision making. Many did not see it as a panic situation for this reason, and when one service down grades you, the others always automatically follow.

One issue of the bailout meetings was the rate at which the government would swap for the subprime loans in the plan then under discussion. Should it be the hold-to-maturity value, ie the full anticipated value when issued for its maturity or some reduced or discounted value, particularly the current market value, known as mark to the market, as determined in their distressed current condition and its effect on their current trading levels. Both Federal Reserve Chairman Ben Bernanke and then Secretary of the Treasury Henry M. Paulson, Jr., were quite clear and stressful when speaking publicly about this that the subprime debt should be purchased at hold-to-maturity or full value to adequately capitalize the income streams and liquidity to the receiving banks so that they would be in a strong position to generate business at the local levels and keep the economy from slipping into a recession. They also stressed for similar reasons that the bailout should insure that no large banks fail, and that numerous small bank failures would not be acceptable either. WaMu was the largest thrift in the nation and all indications were that it was a prime candidate to succeed from the bailout. WaMu though made it clear that if a merger was not completed before the bailout they would continue to look for a merger partner after in any case. As events unfolded the sincerity of those that made remarks concerning no large bank failures has to be questioned, and it has to be questioned if they were deliberately misleading the investing public. In general bank share prices drifted downward as the bailout meetings got underway. There was bickering, Pres. Bush invited both Senators McCain and Obama to a White House meeting that ended chaotically. I personally was unable to watch the hearings on TV, but those who did, did not seem inspired. The expected short squeeze in WaMu from the SEC ban on shorts in financials had not materialized. It should have taken seven days at recent typical daily volume levels for the number of shorts to cover. Volume levels for the 22nd, 23rd and 24th do not show this short covering. There was higher volume on the 25th, but not enough for the shorts to have covered, and this volume was all related to the sell off from that days seizure talk and actual seizure. If JPMorgan Chase or Citigroup or their confidents had been a major shorter of WaMu they had not covered. As usual the SEC and no one in government has ever had anything to say about these uncovered short sellers, and they can’t say anything, or they will expose their inability to enforce regulation of the very systems they are designed to control.

Wednesday evening September 24th President Bush gave a televised speech to the nation on the economic problems and the bailout. One remarkable statement he made was that the subprime debt would be purchased at current market, very depressed, prices. This was the exact opposite of what the Federal Reserve and the Treasury had been saying. It also seemed to contradict the purpose of doing a bailout.

Thursday September 25th was in general a day bank shares drifted down and the hearings produced no results. WaMu’s stock began falling within the first hour, and this was attributed to the downgrades of the previous day and evening. I worked that morning, and was not at my computer until after the regular trading. I do not watch CNBC either, but during the day CNBC reported they had leaked information that WaMu would be seized by the FDIC as a bank failure. They did not report a source for this leak. This leak accelerated both the large retail online withdrawals of deposits from WaMu and the falling stock price for the day for WaMu. WaMu’s stock fell almost a whole dollar and 35% for the day. I remember getting home in the early afternoon west coast time, and the market had just closed. I was taken aback by the dollar drop for the day. Looking on the message boards I thought I understood the sellers concerns, but believed that the government would prevail. No one mentioned a seizure. This was the mindset that week, in fact Warren Buffett considered one of the best investors going, had late Tuesday September 23rd bought $5 billion dollars of Goldman Sachs stocks for essentially the same reason. As by now all shorts were supposed to be covered and out of the market, even though there was no evidence this ever happened in WaMu, the steep fall in price was being partially explained as due to this normal braking mechanism to the market having been removed. I looked at an early after hours quote and it was a few pennies from the regular market close of $1.69. I surfed onto some noninvestment things. In less than an hour I checked back and the quote was $0.52. At this point selling was of little benefit and I decided to hold, for a possible recovery. A drop of another dollar and two dollars for the day. I went to the Yahoo WM message board and began looking at posts. Some people were up in arms, some people said it was oversold panic selling etc. I stayed and watched the posting and began reading news sites for news. First there were posts on WaMu closing. This made no sense. I saw a post where the word seized was used. It had only one news source anyone could find backing it. I was unaware of CNBC’s earlier reporting in the day.

WaMu’s price by now was at about $0.16 where it would close, though it did go as low as $0.09 from my memory. It was discussed what they meant by seized. At about this time after hours trading ended and there was suddenly a storm of news stories about WaMu and the seizure and we learned the following. Most investors understood that Washington Mutual Inc was a holding company trading under the symbol WM and that the holding company was the owner of the Washington Mutual Bank. The shares were shares of the holding company, not the bank. Many banking companies are set up this way and here is a list of the top fifty bank holding companies. The OTS and FDIC recognized this as well and chose to exploit this corporate structure. Without a public word they realized that the WaMu bank could be seized and that the shareholders and bondholders of Washington Mutual Inc. would lose the primary asset of their company, but that their claims would not be directed at them for the possession of the asset, but rather would be directed at the holding co, which they owned shares in. Had everything been exactly the same for the WaMu Bank, but that the shares and debts been in the bank’s name and not the holding companies, it is likely the bank would not have been seized. That the corporate structure allowed a loophole to screw the shareholders and debt holders is really the reason the WaMu bank was seized. At about 7:00pm JPMorgan Chase announced they would be holding a Conference Call at 9:15pm. The conference call was used to announce to the world they now owned WaMu. JPMorgan Chase also released this press release that evening, and later this presentation (pdf.link). In the eleven trading days following the seizure, Friday September 26, 2020 through Friday October 10, 2020, the markets crashed. The DJIA fell 24.15%, the NASDAQ fell 24.45% and the S&P500 fell 25.88%. They have yet to recover.

Let us assume for the sake of arguement that 1,000 people in the Wall St and Manhattan circles had advance knowledge of the FDIC’s secret plan to seize and auction WaMu. This would be a large number of in the know people for such a critical deal in my opinion. What are the odds that one of these 1,000 people of the seven million people in New York would be called upon to give an interview on the subject of WaMu just prior to the seizure and bailout vote. What are the odds that this one selected in the know person deemed worthy enough to just be freely and for no reason given this information, during this critically timed interview, is also careless enough to just let fall from his lips that there is a secret auction in the works. Then the follow-up is that this seizure, by far the largest bank seizure in US history, mysteriously has to be moved up a day and results in an ambush of all the investors who normally would have opted out of the risk and sold before the weekend. The odds are probably about the same as of the planet being taken out by a huge asteroid.

JPMorgan Chase is one of the primary stockholders of the Federal Reserve which means they have the power to force favors from the Federal Reserve. The CEO of JPMorgan Chase, Jaime Dimon, sits on The Board of Directors of the Federal Reserve Bank of NY. Citigroup is also a stock holder of the Federal Reserve. It is the Federal Reserves job to insure that its member banks have the liquidity to transact business. The member banks borrow and lend among themselves electronically every night to keep each other liquid. This is called the Federal Funds. If need be a bank can also borrow directly from the Federal Reserve itself through a process known as the Discount Window. The FDIC was in a jam in that if WaMu was ever deprived of funds from the Federal Reserve, say for fear of not being paid back, and a bank run ensued, the FDIC would not be able to cover the insured deposits without borrowing from the Treasury. There are some slight differences in the amount the FDIC would have had to cover. Some estimates leave the FDIC with a nominal balance. Apparently the thought of having to borrow funds from the Treasury so early in the credit crisis was considered too much of a defeat for the FDIC to be comfortable with. Unknown to anyone in the public the FDIC was working on a secret solution deal. On one hand they were talking with WaMu about helping them find a buyer and the valuation of its loan portfolio, and secretly on the other hand they were allowing JPMorgan Chase and the other banks to have complete access to WaMu’s books and were offering to seize the bank and sell it to them in a private auction, which would free the purchaser from all liabilities to the debt holders, and all claims from shareholders. This would get the FDIC out of their jam. The words Toxic Paper, Toxic Debt, Toxic Loans etc suddenly were all over the newspapers and the internet. The idea that the FDIC’s cash balances could not make good on its insurance liabilities was being well advertised, but their credit line and credit abilities with the Treasury were seldom mentioned. Though borrowing from the Treasury would make the FDIC solvent, accounts over $100,000 would still lose everything above $100,000. These accounts read the writing on the wall and began silently electronically removing their funds from WaMu. As mentioned the Federal Reserve inspectors would be on hand to witness this day by day. WaMu’s cash on hand and hence liquidity was being drawn down. Did the Federal Reserve step in and loan them this liquidity as the system is set up to do for just these type of incidents. No they did not (pdf link). Was the reason because WaMu still had plenty of liquidity left, or was there some cooperation going on between the Federal Reserve, the FDIC and the Treasury? This all occurred as the Congressional bailout meetings were underway.

Once the bailout was completed, the plan being discussed, would have WaMu’s bad subprime loans swapped out for good government paper, maybe some at 100%, maybe some at a discounted level, maybe some at market level. WaMu’s improved condition in any case would make it a much more solid purchase after the bailout then before. WaMu was being set-up in a triangulation of cross fire, between the Federal Reserve, the Treasury Department’s OTS, and the FDIC, to affect a seizure and a fire sale at auction. The beneficiary’s of this would be the FDIC, which would be removed of the potential problem of having to go into debt to the Treasury if it ever needed to pay the insurance on WaMu’s deposits, the Treasury which would now not have to considering ever loaning the FDIC any money to cover the deposits, and the big winner the Federal Reserve/JPMorgan Chase which ended up owning WaMu, its loan portfolio, its badly needed cash deposits, and its jewel of branch networks, free of all bondholder obligations and claims of shareholders.

There is also the consideration that JPMorgan badly needed the cash from the deposit base of WaMu to help shore-up its very leveraged derivatives trading transactions. JPMorgan’s acquisition of Bear Stearns, also done with the government’s help, is thought to have been done for this same reason. If JPMorgan were ever unable to fulfill their ends of their derivatives trades, and collapse, it is thought it would bring down all of Wall St and the economy. Some of these trades were with WaMu and these trades would self cover and cancel, just as it was done with their Bear Stearns trades. Thus the actions of the OTS, FDIC and Federal Reserve may not be entirely about money, but also about their reputation and their performance of duty, and that they chose to kill off WaMu to save their own necks by helping to save JPMorgan’s neck. WaMu’s parent company Washington Mutual Inc shareholders and bondholders though were forced into taking an unjustified catastrophic and total loss. The investors of Lehman Brothers have also pointed the finger at JP Morgan and accused them of withholding liquidity from Lehman causing their collapse.

Probably the single worst thing about the WaMu seizure was it destroyed the financial order of American capitalism for finance companies by removing the rights and claims of all investors on the corporation, and in turn removed the priorities in rights and claims of the different securities issued by finance corporations and purchased by investors. John Hempton who blogs for the Bronte Capital Blog said it well in his September 28, 2020 entry The Reckless, Irresponsible Seizure of Washington Mutual (link). “Now there is not much raising of wholesale funds by banks at the moment. But after this deal there is likely to be less. It is simply the case that there is now a new risk for people who provide wholesale funding – and that risk is that the government will unilaterally abrogate their rights – without appeal, without due process and without accountability….that the most important function of government in a capitalist society is provision of a framework by which property rights can be defined and enforced as this is the key to making a capitalist society function….The Government is now acting as if the framework does not apply to them….That is bad whatever your political persuasion….But in the process they have doomed about two thirds of the US banking system….heaven help us.” Please read the entire entry at the link.

The Federal Reserve watched WaMu, while knowing their own stockholders, JPMorgan Chase and Citigroup, were participating in secret backroom discussions with the FDIC wherein it was decided the Treasury Department’s OTS would seize WaMu for “lack of liquidity” and give it to the FDIC who would have it auctioned off in advance. Included would be the branches, deposits, and the loan portfolio including subprime mortgages, which were eligible to wash off as a write down to the final amount paid, and what was not written down and washed off, would be eligible for swaps under the bailout plan. All for a fire sale private auction price, and leaving WaMu Inc the holding company hanging onto all the obligations to the bond holders, as well as all the obligations to the preferred shareholders, and all claims by common shareholders. The winner, at $1.9 billion was JPMorgan Chase. JPMorgan Chase was able to take a $31 billion write down on the subprime mortgage loans as part of the deal, even though WaMu had previously calculated $19 billion as the bad loan amount. The unsecured mortgage loans JPMorgan took and could not write down would still be eligible for the federal bailout plan. JPMorgan also got the WaMu bank branches throughout the country especially the west and south they had wanted so badly. If JPMorgan Chase or any of the other banks in the secret dealings had major short positions, they had not covered. When WaMu’s stock price collapsed after the seizure, they could cover for cheap, or maybe just be able to hide the fact. When a company declares bankruptcy shorts do not have to cover - it is game over. That a lot of the shorts never covered in WaMu and that certain large banks were privy to the FDIC’s plan to seize and close the bank, would make it simple for these banks, their friends, confidants, and all their proxies, to never cover their shorts and keep a large profit. This would help cover a lot of bad derivative trades and may be why it is not being discussed. That nothing has been written about this makes it even more likely this is what happened. This would be insider trading, an illegal act. As Congress discussed the bailout on Thursday September 25th, and after regular market hours, the OTS seized control of WaMu, and turned it over to the FDIC who immediately turned it over to the auction winner JP Morgan Chase. This was announced after all trading had ended, simultaneously as one single packaged story. Bank seizures are traditionally done on Friday evenings so the weekend can be used to sort out the paperwork and details. Investors planning to watch WaMu’s Friday trading action and planning to decide whether to hold or not considering a possible Friday evening seizure were robbed of the opportunity. The OTS/FDIC said they chose Thursday because of the leaked seizure report being circulated, and thus imply that a very real potential, a final agreement to the bailout meetings on Friday, was not a consideration. They say they feared the leak would increase the rate of withdrawals leaving WaMu that Friday. This has to have been one of the most valuable leaked reports in American history and one wonders if those who benefited so handsomely from it may have also behind it. As a further deflection, although a loan swap had been sold to everyone as the bailout all along, the Treasury pulled a surprise on everyone after the bailout was passed and did a preferred stock purchasing plan instead. Was this to distance themselves from the WaMu take down and modus operandi behind it?

JP Morgan Chase had at least three weeks to prepare their bid, during which time they had at least seventy-five of their own people crunching numbers and working forecasts, using the data WaMu had supplied to the FDIC under the understanding that the FDIC would help them facilitate a buy-out merger transaction. Bids were submitted on the 23rd and the FDIC notified JPMorgan Chase they had the winning bid on the same day. The $1.9 billion was paid to the FDIC, who say it will be used to toward paying off the debt holders.

J.P. Morgan becomes the country’s largest bank by deposits, with more than $900 billion in deposits, and second largest overall. They added WaMu’s 2,239 branches in 15 states, many in key states where they had little or no presence, like California, Oregon, Washington and Florida and becoming stronger in states where they were low and mid level players, like Texas, Colorado, Utah and Illinois.

J.P. Morgan acquired all of the assets, all of the bank branches, and all of the deposits of Washington Mutual Bank and nothing of the holding company’s Washington Mutual Inc. Washington Mutual Inc retained only the senior unsecured debt, subordinated unsecured debt, and preferred and common stock. Due to the seizure, the next day Friday September 26th Washington Mutual Inc filed for Chapter 11 bankruptcy, a reorganization, and listed assets of $32.9 billion, and total debt of $8.2 billion. Most of the assets were shares of the seized bank valued at the preseizure price.

A little needs to be said about bank deposits. To a bank, bank deposits are a liability because the bank owes the money, plus the interest promised, back to the depositor. This is obviously true. What needs to be considered is that the banking system is based on fractional reserves. When a bank receives a thousand dollars in deposits it gets to lend out, most of the money, at a higher interest rate than it pays depositors. In the USA the reserve requirement is about 10% (10.3% actually). The bank receives say a thousand dollars, promises 2.5% on it, loans out $900 and receives 7.5% on it, and keeps the difference. If money the bank has loaned out, is redeposited back into the bank, they can repeat the process with that deposit. Banks make good money off of the deposits. Banks do a lot of advertising and customer service benefits to get people to deposit money at their bank. It is a slow trudging process to build up a banks depository base. When JPMorgan Chase received $188 billion in WaMu deposits, the amount of deposits on the date of seizure, for a $1.9 billion payment, plus all the WaMu assets, it was a huge steal of a deal. Now consider that to build deposits a bank has to be located in areas convenient to entice depositors to deposit with them. The bank needs a branch network. This is a costly, slow to build, trial and error system that generally takes years and decades to create. It is a highly valuable asset. JPMorgan Chase also got all of the WaMu bank branch system as part of the deal. Also as part of the deal they got to write off all the bad loans they felt WaMu had on its books, $30.7 billion was the figure they agreed to. JPMorgan also got WaMu’s two credit card companies, WaMu issued Mastercard and Visa cards that it had long maintained, and Providian Finance a leading credit card issuer purchased by Washington Mutual for $6.5 billion in cash and stock in October 2005. So JPMorgan’s risks were all washed away and their benefits were enormous, and they paid a measly $1.9 billion for the whole deal. It was the WaMu investors who paid for this deal, by receiving nothing for their bank’s deposits, loan portfolio, real estate, branch network, and credit card businesses, a total robbery.

The mortgage assets JP Morgan acquired were $176 billion of WaMu’s home loans. Those assets were immediately written down by 19%, or $30.7 billion. Leaving JPMorgan with a cool $145 billion dollars of good assets, some that are eligible for the bailout plan, for which they paid less than $2 billion dollars, and this does not include the real estate and other assets. Much of the real estate was actually owned by WMI and was seized and sold illegally. The only liabilities they took were the deposits. A few weeks after the dust settled from the seizure it was revealed that WaMu Inc., the holding company, had $4.4 billion dollars in accounts in the WaMu bank. The FDIC tried to claim this money in court as part of their receivership, but the courts ruled it belongs to WaMu Inc. If WaMu Inc, the holding company, had been invited to the secret private auction, and bid the balance of just these accounts, as most people think they gladly would have, they would have won and beaten JPMorgan’s bid by more than two times.

JP Morgan expects the deal to generate $12 billion dollars over the next three years, or $4 billion dollars a year, making them a 100% profit on the deal in the first year, and an additional 200% profit every year from then on. Thus the increase in earnings per share will be immediate and is expected to be between $0.50 and $0.70 a year, starting in 2009 and every year thereafter. The owners of the company, the Washington Mutual Inc shareholders, received zero dollars on their shares, and they now trade at around three cents. They had their primary asset preemptively confiscated and sold, for less than two cents on the dollar, which they do not even receive, for the so called reason that it suffered occasional short term liquidity problems and those whose duty it was to help them out with liquidity problems didn’t want to, and the FDIC that guaranteed some of its liabilities didn’t want to take the extremely unlikely and extremely short-term and extremely slight risk that they may need to pay on their guarantees should WaMu actually not be able meet withdrawals before possible benefits from the bailout began and/or a buyer was found and the bank sold off at a fair value. Though simply giving WaMu depositors a temporary increase in FDIC insurance coverage would have been all that was needed to remove this one highly unlikely potential problem. Unless of course they felt some extremely powerful outside force could precipitate this problem. The bailout which at the time was about to be passed in the forth coming week, maybe even the next day, would have possibly eliminated this problem, and the mere completion of the bailout would have cleared away the final unknowns in the way of a buyout merger. Although in reality the buyout option had already been secretly sabotaged and ruined by the FDIC’s secret auction agreements, leaving them no choice but to finish with seizing the bank and it would look a lot better done before the bailout was passed. The liquidity problem would have taken weeks or even months to occur even without a bailout and only if the worst happened or a media campaign was done, and WaMu remained abandoned. Yet because of a news leak the OTS justified seizing WaMu immediately before the bailout passed. The seizure and its timing also hugely benefited the brazen uncovered shorts, whomever they were. Washington Mutual Inc and its shareholders were set-up by WaMu’s family and friends and then robbed and murdered by them. The whole WaMu take down was accomplished by subterfuge, sabotage, deceit, propaganda, lies, illegitimate seizure, done irregularly, on the sly, in secret, in darkness, under camouflage of smoke and mirrors, on leaked news, and ended solely to the financial advantage of the FDIC, the Treasury Dept, the Federal Reserve/JPMorgan Chase, the uncovered shorts, and those rich enough to keep over $100,000 in their bank accounts. WaMu shareholders were totally wiped out. It was a thirty billion dollar rip off.

To add insult to injury after EESA 2008 was made law on October 3rd 2008 JPMorgan Chase became one of nine banks to receive money from the EESA funds in exchange for preferred shares created especially for this purpose. On October 14th JPMorgan Chase received $25 billion from the EESA funds. In effect the government paid back JPMorgan Chase for taking WaMu and then paid them a $23 billion bonus for doing it, on top of all the write offs. WaMu would not have even needed $23 billion in mortgage guarantees to be effortlessly merged and preserving the shareholders and bond holders investments and the soundness and thus confidence in the US financial system. It was a tragic move by the FDIC.

For those who say WaMu made bad loans and so the deserved to be taken down, it isn’t true. WaMu’s bad loan rate was 3.62%, that is not enough to justify the trillions of dollars sucked out of the economy by the WaMu catastrophe. Further more JPMorgan Chase is drowning in bad derivative trades, far more than WaMu’s bad home loans. It is more moral to make a bad home loan, which leaves a house and a place for someone to live, then it is to lose even more billions in bad derivative trades which leave nothing but worthless paper. WaMu deserved government assistance more than JPMorgan Chase.

For another perspective on WaMu consider that IndyMac, a bank about 10% WaMu’s size, was seized and later sold for $13.9 billion. Wachovia Bank which the FDIC threatened to seize and tried to force into a sale to Citigroup for $2.1 billion, almost the same price as JPMorgan paid for WaMu, was sold within a week to Wells Fargo without any government assistance for $15.4 billion. There were details to these sales, and there were considerations, but WaMu was easily as viable as either of them, and with a little financial finesse, seized or not, could have easily been sold for considerably more as well.

http://www.wamu-shareholders-resources.com/wamued.html

by Daniel Wood/aka testorx, testorx2

Related Blogs

- Tax Research UK » 'Debt is good' message may be luring young …

- Fujitsu, Toshiba To Merger For Mobile Operations | ShutterVoice …

- DJ Orphanides ECB To Adjust Liquidity Provisions As Appropriate …

- Your New Car Value Drops When You Drive It Home | Car Audio Blog

- Biz journal reporter to write book about WaMu's rise and fall …

- Legal News – Your Source for Legal News and Advice | Can Filing …

- Legal News – Your Source for Legal News and Advice | Handling …

- Legal News – Your Source for Legal News and Advice | Arizona …

- Panel Pane visibility on cck field value « Drupal Answers from …

- Breaking: Major Banks File Bankruptcy – Lehman Brothers …

- The First Bailout in India and the Depression 2008 | Pharmacy …

- VIDEO Y LETRA - Wake Me Up When September Ends de Green Day …

- We Can Probably Stop With The Bank Failure Counts The Reformed Broker

- FDIC Bank Failures ($ Inflation Adjusted) | The Big Picture

- Government – Bank Symbiosis | The Big Picture

- ETFs: “F” for Liquidity | The Big Picture

- Utopia: The End of Men, Sweden, and the Progressive Endgame | RedState

- Bankruptcy Lawyer Firm Bonall We Know Bankruptcy Best

- Bankruptcy Lawyer Firm City Heights We Know Bankruptcy Best

- The Progressive Economics Forum » Liberal-NDP Merger?

+0.01

+0.01 +0.02

+0.02 +0.00

+0.00 +0.02

+0.02